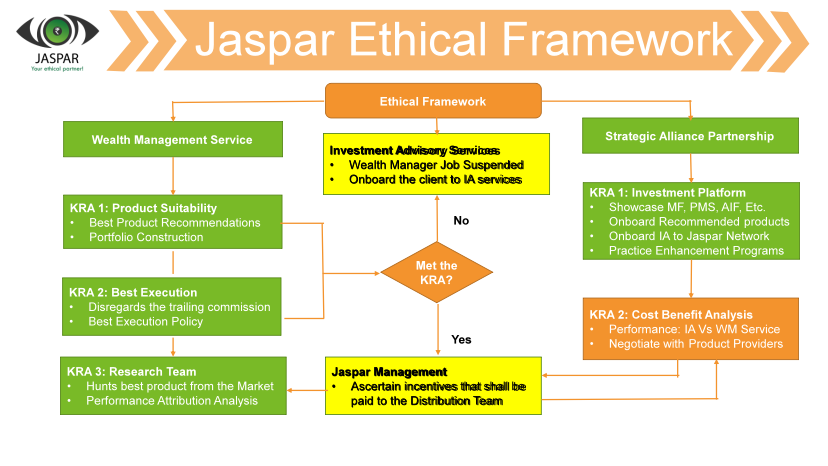

Jaspar stand for Ethical Partnership with our clients. Organization is designed based on the Ethical Frame Work that ensures no conflict of interest between the services offered by our business divisions. Our client is our focal point in all we do. Hence each of our business divisions works in silos in the interest of you.

As per our ethical framework there is a clear division between Wealth Management Services Division who evaluates the suitable products that meets the financial goals of our client and the Strategic Alliance Partnership division who brings forth every financial product that are available in the market to our platform. In between these two divisions, Investment Advisory Services Division is there that onboard clients to the services of an Independent Financial Advisors when the client opts for it or if the performance of the Distribution service does not meet the expectation.

There are Chinese walls between the workings of these division. There is no interaction whatsoever between each of these divisions. Each of these divisions have dual reporting role to the Managing Partner and the Principal Compliance Officer.

This division provides the Execution Only services and is headed by Manager – Portfolio Construction. We do not charge our client for advising suitable financial products, as our core function is distribution of financial products. However, this team works independently and do not have any view of which product earns more revenue for Jaspar.

Their Key Responsibility Area (KRA) is to find the best product that suits your risk profile and execute it in a way that is most cost effective. However, this team executes only regular schemes as they are from the distribution side.

There is a research team that surfs through the market to hunt for investment avenue that are doing well in the market. This team also runs Performance Attribution analysis to understand the performance of various managed portfolios.

The success of this division is measured based on the performance of your investment portfolio and whether it was able to meet your financial goals.

We have a suit if SEBI regulated Investment Advisors (IA) who are onboarded to our platform. They also offer a complete suite of advisory services same as that of Wealth Management (WM) Service Division. They differ from WM services in that they charge advisory fee directly from the client as against the WM services that do not charge anything to their client but earns trailing commission as product distributor.

The investment advisory fee that are charged by the IA are within the limits prescribed by the SEBI. Jaspar helps our clients to establish the Advisory relationship with the SEBI registered Investment Advisor.

They also offer a complete suite of advisory services same as that of Wealth Management (WM) Service Division. They differ from WM services in that they charge advisory fee directly from the client as against the WM services that do not charge anything to their client but earns trailing commission as product distributor.

Jaspar acts as an aggregating entity that associates itself with several financial product producers so that these products are made available through our platform. The research team under the Wealth Management Division does the research and data analysis and shortlist a range of products that are performing well in the market and ensures to have these products in our offering.

Currently our platform offers investment through managed portfolios such as Mutual Funds (MF), Portfolio Management Services (PMS), Alternative Investment Funds (AIF), etc., that comes under the ambit of SEBI and RBI. Our platform also Insurance Products such as for Life Insurance, Health Insurance, Critical Illness Insurance, Accident Insurance, etc., that comes under the ambit of IRDAI.

Our platform also offers Retirement Products such as National Pension Schemes (NPS), Retirement Advisory, etc., that comes under the ambit of PFRDA. Our platform also arranges for various Loans from Bank and NBFCs that comes under the ambit of RBI.

Jaspar Wealth Management – Building and preserving wealth for our clients through personalized and expert financial guidance.

Copyright © 2024 jaspar All Rights Reserved | Designed By RepuNEXT